krfacts December Edition 2023 Legal Changes in 2024

With the start of each new year, numerous new laws and regulations come into force or are amended. Navigating through these regulations becomes increasingly challenging. We have summarized the most important changes for the coming year for you.

AHV 21 reform

On 25 September 2022, the Swiss electorate approved the reform to stabilize old-age and survivors' insurance (AHV). The reform, which comes into force on January 1, 2024, includes an amendment to the AHV Act and a federal decree on the additional financing of the AHV through an increase in value-added tax (VAT).

Amendment of the AHV Act

The revision focuses on increasing the normal retirement age (new: reference age) for women and thus standardizing the reference age for women and men. The reference age corresponds to the age at which the AHV pension can be drawn without deductions or supplements. This will be increased in four stages from age 64 to 65. When it comes into force on January 1, 2024, the reference age for women will rise by three months for the first time on January 1, 2025, i.e. to 64 years and three months. Women born in 1961 will be affected first, followed by women born in 1962, for whom the reference age will be 64 years and six months, then 64 years and nine months for women born in 1963 and finally 65 years from 1964 onwards. From the beginning of 2028, the reference age of 65 will apply to everyone. The law provides for compensatory measures in favor of women born between 1961 and 1969. The gradual increase in the reference age also applies to occupational pensions.

Furthermore, the time at which the AHV pension is drawn can be chosen more flexibly. As before, the AHV pension can be drawn at the earliest two years before reaching the reference age and deferred for a maximum of five years. However, early withdrawal or deferral is now also possible on a monthly basis and no longer only in whole years. In addition, it is now also possible to draw part of the retirement pension, whereby at least 20% and a maximum of 80% of the full pension can be drawn and the remainder deferred. This is intended to facilitate the gradual transition into retirement.

Finally, as before, every person who works beyond the reference age and earns more than the exemption amount (2023: CHF 1,400 per month) must pay AHV contributions. These contributions do not currently lead to a higher pension. In the future, the AHV contributions made after the age of 65 will also be taken into account when calculating the pension, which can close contribution gaps. It is also possible to voluntarily waive the allowance. However, anyone who has already reached the maximum AHV retirement pension cannot increase it any further.

Increase in VAT

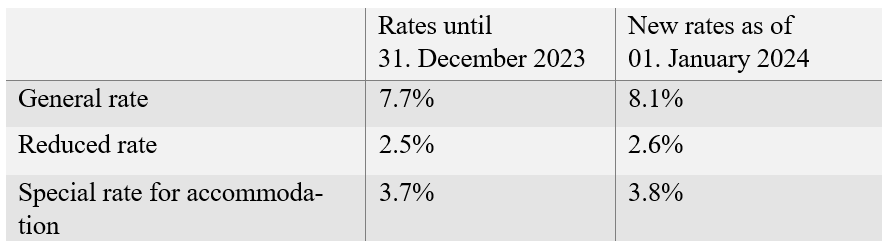

In order to eliminate the deficit in the Swiss pension system, it was decided, among other things, to increase VAT rates as follows:

The VAT liability continues to arise at the time of invoicing or upon receipt of payment, regardless of the applicable tax rate. However, the key date for the applicable tax rate is not the invoice date or the date of receipt of payment, but the time or period of service provision. After January 1, 2024, invoices with a service date/period of 2023 or earlier can therefore be issued at the old tax rates without any problems. The same applies, for example, to the derecognition of receivables that are no longer enforceable for services rendered before January 1, 2024. In this sense, there is no deadline after which the old tax rates may no longer be used on invoices.

New foundation law

After almost seven years of debate, Parliament passed the revised foundation law on December 17, 2021. Firstly, from January 1, 2024, the founder's rights will be extended. Previously, under Art. 86a ZGB, the founder only had the option of changing the purpose of the foundation if he had reserved the right to do so. In the future, in addition to the right to change the purpose, a right to change the organization will be created. Secondly, the requirements for insignificant amendments to the foundation deed will be relaxed. Insignificant amendments to the foundation deed are now possible, provided this appears justified for objective reasons and does not affect the rights of third parties (Art. 86b nZGB). This means that they no longer have to appear necessary for valid objective reasons. Thirdly, it is clarified that amendments to the foundation deed pursuant to Art. 85-86b (amendment of the organization, amendment of the purpose, insignificant amendments to the foundation deed), which are decreed by the competent federal or cantonal authority or supervisory authority, do not require public notarization. Fourthly and finally, the foundation supervisory appeal is codified in Art. 84 para. 3 nZGB. Accordingly, beneficiaries or creditors of the foundation, the founder, contributors and former and current members of the foundation board who have an interest in ensuring that the administration of the foundation complies with the law and the foundation deed may lodge a complaint with the supervisory authority against acts and omissions by the foundation's governing bodies. The final list of persons entitled to lodge a complaint puts an end to the current problems surrounding the right of appeal.

Abolition of industrial tariffs

At its meeting on February 2, 2022, the Federal Council decided to abolish industrial tariffs with effect from January 1, 2024. In Switzerland, industrial products are all goods with the exception of agricultural products (including processed agricultural products and animal feed) and fishery products. This means that these products will no longer be subject to customs duties when imported into Switzerland from the new year.

The abolition of industrial tariffs is part of a package of measures aimed at reducing Switzerland's trade barriers. While customs duties were previously intended to protect domestic industry from foreign competition, they now make the procurement of raw materials from abroad more expensive. Thanks to the abolition of customs duties and the associated administrative simplification of customs procedures, companies in Switzerland benefit from cheaper inputs and can therefore reduce their production costs.

New regulation of insurance brokerage

The new regulation of insurance mediation from January 1, 2024 should also be mentioned. This is when the revised Insurance Supervision Act (ISA) and the revised Supervision Ordinance (SO) come into force. The new regulation will impose a number of new obligations on insurance intermediaries and stricter criteria will apply for placing intermediaries under FINMA supervision. For example, insurance intermediaries now have information, disclosure and reporting obligations as well as the duty to take appropriate organizational precautions to avoid conflicts of interest in their brokerage activities. In addition, proof of education and training must be submitted to the supervisory authority. In future, there will also be a clear distinction between tied insurance intermediaries who have a fiduciary relationship with an insurance company and non-tied insurance intermediaries who have a fiduciary relationship with their client. In particular, higher registration requirements apply to independent insurance intermediaries.

The new legal situation is intended to ensure that independent insurance intermediaries can offer a higher quality of advice and that customers are better protected. To all insurance brokers: Get active! We strongly recommend that you familiarize yourself with the new requirements and examine them carefully.

Adjustment to the assessment of the degree of disability

An amendment to the Ordinance on Disability Insurance (IVV) will also come into force on January 1, 2024, which is intended to improve the assessment of the degree of disability of insured persons for whom no comparison of actual income before and after disability is possible. The hypothetical salaries applied to date, which have been criticized as being too high, will be reduced by a flat-rate deduction of 10% to take account of the restrictions on the labour market. This adjustment will result in higher IV pensions and increased retraining.

Changes to child and adult protection law

Firstly, following an amendment to the Swiss Civil Code (ZGB) from January 1, 2024, the child and adult protection authority (KESB) will no longer only have to inform the civil registry office if a measure it has ordered restricts a person's capacity to act. In the future, it will also be obliged to inform the debt collection office, the ID authority or the land registry office as well as the municipality of residence, depending on the type of measure. On the other hand, the revised Ordinance on Asset Management in the Context of Assistance or Guardianship (VBVV) regulates asset management in child and adult protection measures more precisely and in a more practical manner by defining responsibilities more clearly, specifying open terms and explaining individual provisions. In addition, the permissible investment options are expanded in line with the various needs.

Daily allowances for the surviving parent

The death of a parent immediately after birth is a severe loss for the family and the newborn child. With the entry into force of amendments to the Income Compensation Act (EOG) on January 1, 2024, the surviving parent will in the future be entitled to longer maternity or paternity leave in such cases.

Amendments to the Code of Criminal Procedure

Finally, reference should be made to the numerous amendments to the Code of Criminal Procedure (CPC) adopted by Parliament in June 2022, which will come into force on January 1, 2024. Selective amendments are intended to improve the practicability of the Code of Criminal Procedure, which has been in force since the beginning of 2011. For example, in the future the public prosecutor's office must always question the accused in summary penalty order proceedings if it is to be expected that the summary penalty order will result in a custodial sentence to be served. Furthermore, the public prosecutor's office can now also decide on civil claims of up to CHF 30,000.00 in summary penalty order proceedings if it is possible to assess them without taking further evidence. In the area of victims' rights, the victim's right to information has been extended. In the area of unsealing records or objects, the Code of Criminal Procedure now regulates the procedure more precisely and sets deadlines with the aim of shortening the unsealing procedure and thus helping to speed up complex criminal proceedings in particular.