KMU Magazin No. 7/8, July/August 2023 Variable Pay - Incentive and Obligation

What are the pitfalls and traps the employer has to be aware of regarding variable wages? In the following, a short round trip will refer to the bonus and the most frequently asked questions about it.

After successful completion of further training, the use of the skills acquired in the workplace is one of the most important points in persuading employees to stay with the company (compare "SME Magazine" No. 7/8 2021, page 35 ff.). However, this is often accompanied by a desire to adjust wages. Apart from the basic salary (and allowances), which could be increased, other compensation components are available. In addition to the bonus and voluntary special compensation, internationally active companies often have employee stock ownership programs; however, these will not be discussed further below.

Freedom of contract, but ...

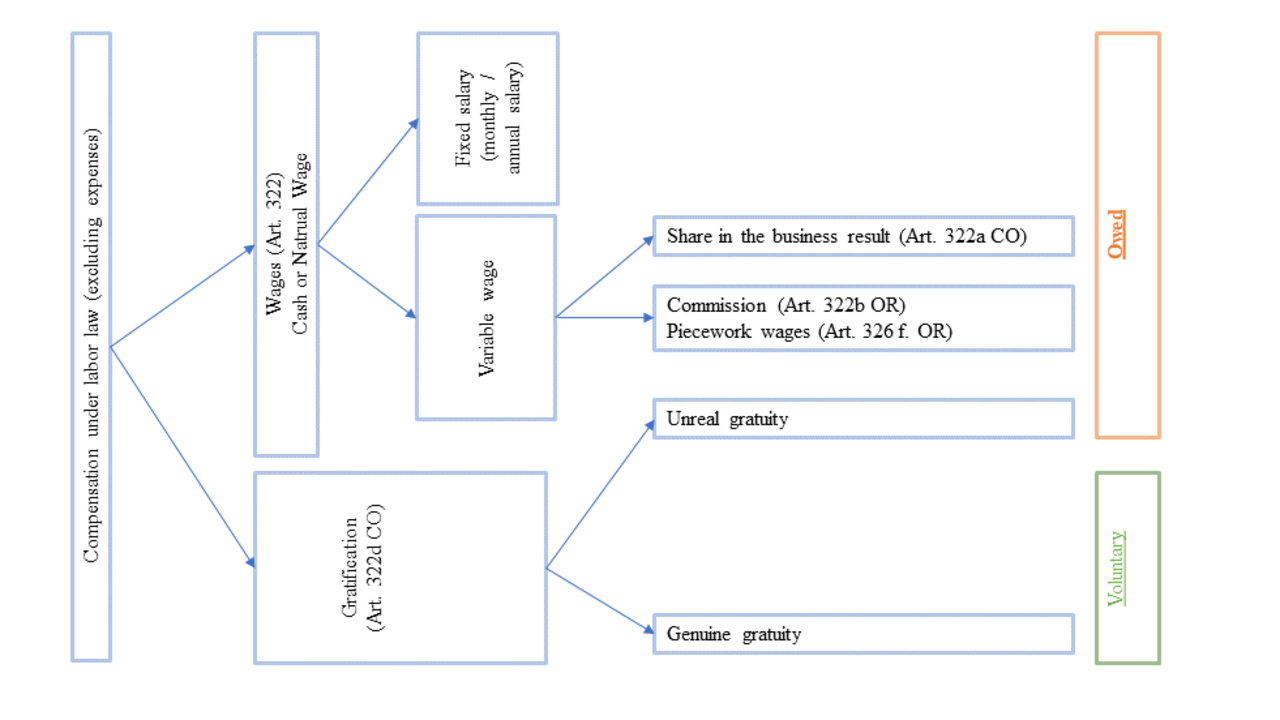

Swiss labor law does not prohibit the parties from deviating from the law and using independent terms and formulations. The terms "bonus" or "premium", for example, are not legally regulated terms. Despite the freedom of contract, however, all contractual arrangements will always have to be legally subsumed under the Swiss wage system in order to determine whether the arrangement made is an owed benefit or a voluntary obligation at the employer's discretion.

Depending on whether the benefit is owed or not, there are different legal consequences. If it is a voluntary benefit (so-called genuine gratuity according to Art. 322d CO), it does not have to be specifically taken into account for the continued payment of wages due to absence from work through no fault of the employee, nor for the calculation of vacation pay, nor for employment relationships lasting less than one year, nor for their amendment. The genuine gratuity can also be linked to conditions, for example that payment is only made if the employment relationship is not terminated. This can be significant, particularly against the background of the principle of discrimination.

However, the situation is quite different if the service is owed. Then the aforementioned legal consequences must be strictly observed.

In this respect, it follows that with the free choice of terms such as bonus or premium, the parties must analyze the content of the contract precisely in order to be able to assess whether, for example, there is a pro rata entitlement in the event of a change of job which must be fulfilled. And it is precisely here that opinions often differ and the parties end up arguing in court as to whether the "bonus" is owed or not.

Basic pillars of compensation

In Swiss labor law, there are absolute and relative mandatory legal provisions. Readers experienced in employment law will be reminded of Art. 361 and Art. 362 of the Swiss Code of Obligations. In these two articles, it is possible to check whether the employment law provision in question may not be amended by the parties at all or only in favor of the employee.

Interesting enough, this list does not include the basic norm of wages (Art. 322 CO). However, due to the objectively essential parts of the contract, the employment contract is always remunerated, which has been confirmed by the Federal Supreme Court. There is no such thing as free work in the sense of an employment contract; from a legal point of view, such constellations must be dealt with by means of favors, the gratuitous assignment or management without assignment. So what are the basic pillars of the wage types that must be observed in addition to the basic norm?

The figure "Basic pillars of compensation" is intended to promote understanding in this context. As the overview shows, there is potential for conflict, particularly in the case of non-genuine gratuities, as these are owed.

Variable compensation

As part of the contract negotiations, the employee's need for variable compensation should often be satisfied. In the event of good performance, a corresponding financial compensation is to be paid after the end of the calendar year. On the other hand, in certain cases the employer wants to reserve the right not to have to pay the bonus. For example, a tight liquidity situation or cases where the employee leaves the company during the year due to termination are to be considered, and a linear approach to performance does not correspond to reality in most companies.

Although the preparation of an interim financial statement could theoretically solve this problem, it seems disproportionate to prepare one when an employee leaves. In the hope of satisfying these conflicting interests, in practice contractual components consisting of variable salary and real and unreal gratuity are often mixed and as a result make it difficult to make a clear assessment as to whether the bonus is owed or not.

As a rule, however, there is a tendency that the bonus is owed. It should be emphasized that in particular bonuses that are linked to a target agreement are often owed because the employer, for example, has simply only created such an agreement in the first year and in the following years fails to conclude new target agreements. Although there are different doctrinal opinions on this, such constellations are often interpreted in court to the detriment of the employer and the bonus is owed in full (!).

Unreal gratuity

Those cases in which a bonus is not owed or is owed only to a very limited extent are characterized by the following: the bonus is owed, but the amount of the special remuneration is undetermined and cannot be determined on the basis of objective criteria because its determination is at the free discretion of the employer. These concepts are frequently found in employee stock option programs.

It is clearly agreed that the employer decides on both the entitlement and its amount at its own discretion. Regrettably, however, there are repeated cases where this voluntary concept is overturned in the final paragraphs of the relevant clause. For example, the employer's discretion is abandoned by linking it to objective criteria or by minimum amounts of the bonus.

From bonus to salary

Even in the event that the interpretation of the contract shows that the bonus is not owed, it can mutate into a wage. Thus, a wage is deemed to exist if a bonus is paid out for more than three consecutive years without a reservation of voluntariness, or if this takes place for more than ten years despite a reservation of voluntariness. In such cases, the reservation of voluntariness is regarded as an empty phrase and results in an amendment to the contract that the gratuity constitutes a wage.

Furthermore, a bonus mutates into a salary if the so-called accessoriness between salary and bonus no longer exists. The more important the bonus is in relation to the salary, the more important it becomes for the employee. The bonus is then no longer a "thank-you bonus" but a component of what the employee needs to earn a living.

Depending on the amount of the fixed salary, the percentage of the bonus is lower. For example, in the case of so-called low wages (per 2020 up to CHF 80,000), a bonus that amounts to around 20 percent of the fixed wage tends to already become the wage owed.

In the case of medium to high salaries, more than 50 percent of the total compensation should always be structured as an owed salary and in any case less than half as a voluntary bonus. However, this so-called accessoriness loses its meaning at very high salaries (per 2020 at around CHF 380,000). Above this threshold, there is no social protection, as the finances cover basic needs by far, and a bonus can no longer mutate into a salary.

Conclusion

Compensation in addition to the fixed salary can make sense and is widespread today. An assessment of whether it is a voluntary or an owed claim under labor law is useful and recommended.